Table of Contents

- Free of Charge Creative Commons bond market Image - Wooden Tiles 2

- Bond Market Projections 2024 - Etty Olympe

- What Bond Market Tells Us - R Blog - RoboForex

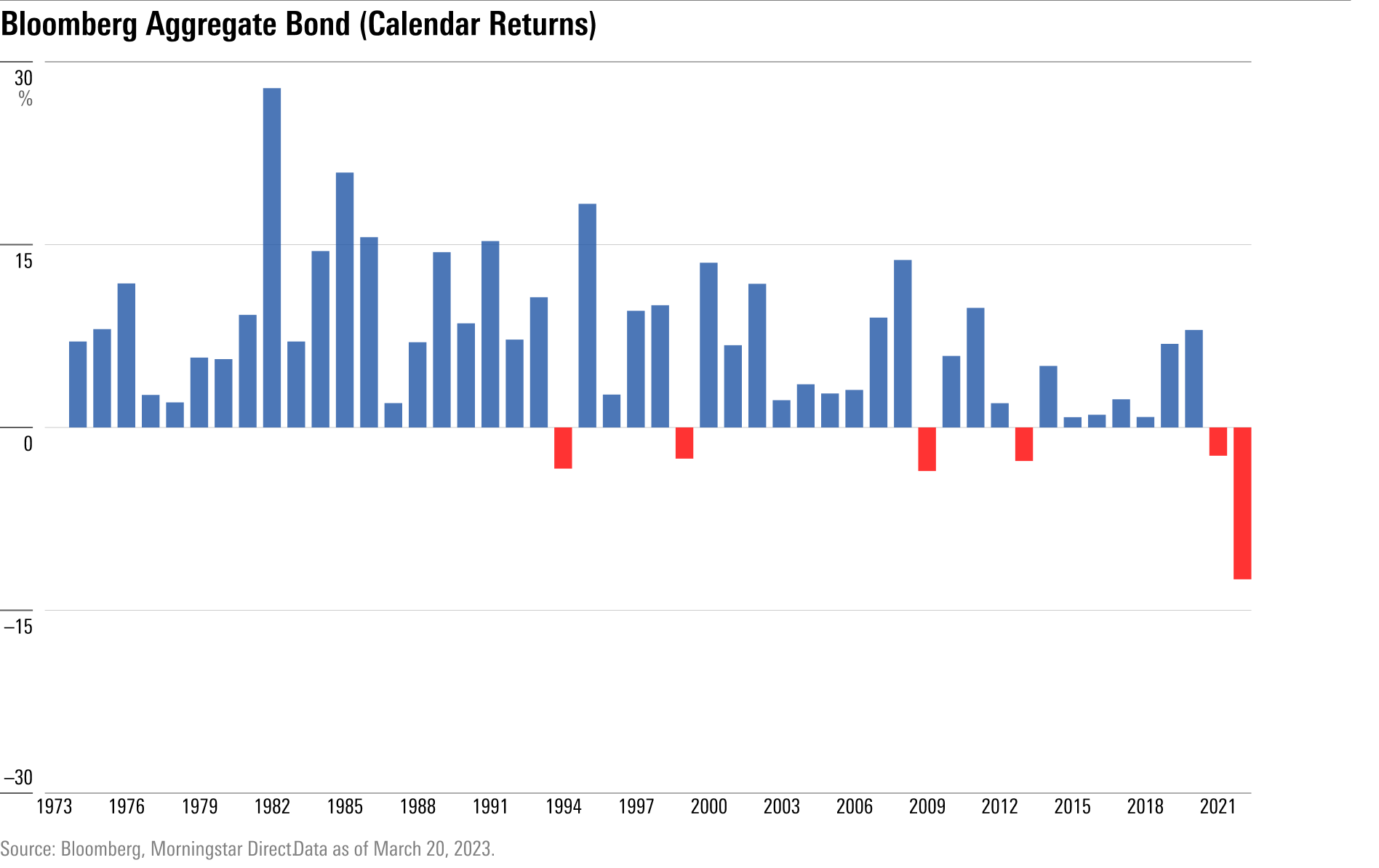

- The Return of the Bond Market | Morningstar

- Foreign outflow from bond market seen continuing in 2018, says RAM ...

- Just 3 Things | Zero Hedge

- Bond Trading May Be Sending a Recession Warning - The New York Times

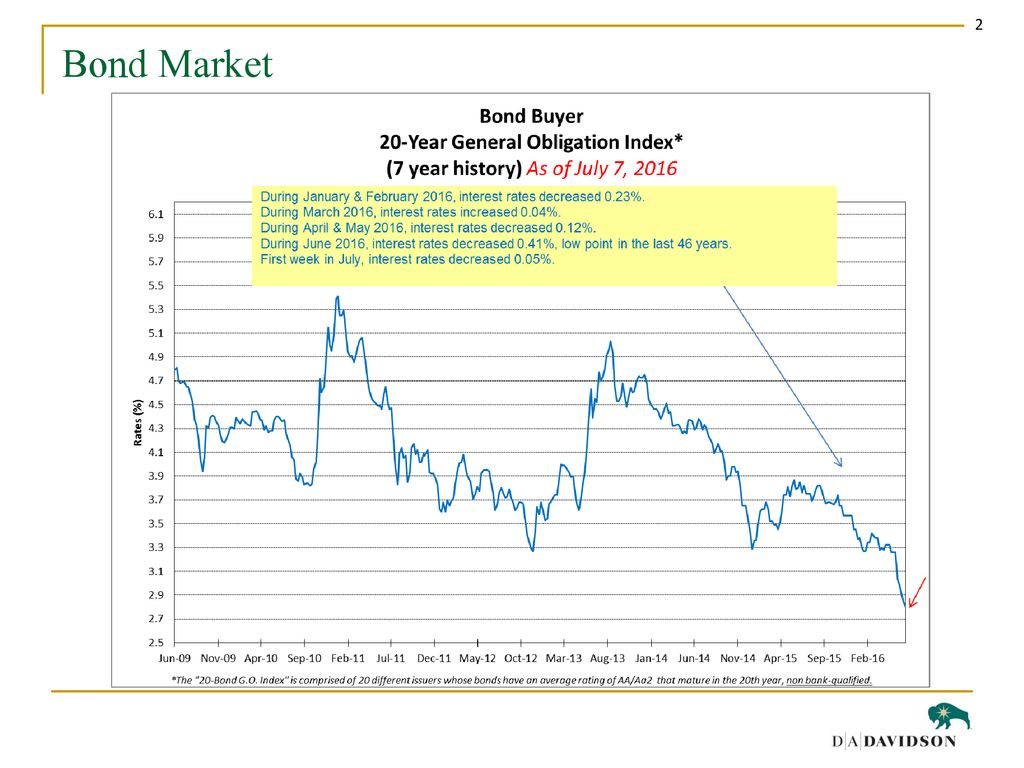

- Refunding bond discussion - ppt download

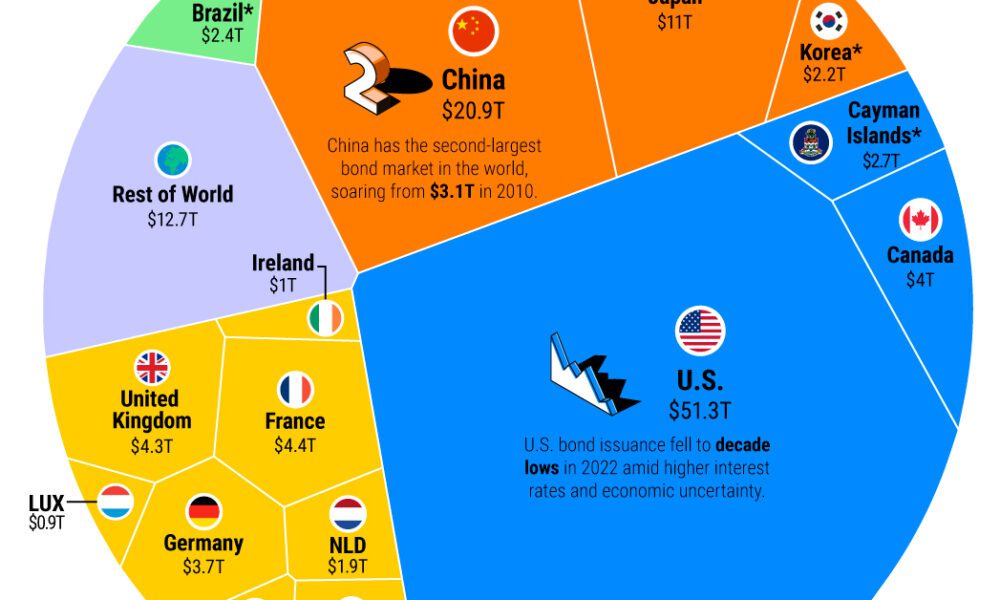

- Ranked: The Largest Bond Markets in the World

- Bond market remains underdeveloped despite years of existence

What are Rates and Bonds?

Bloomberg's Rates and Bonds Platform

Key Features and Tools

Bloomberg's rates and bonds platform offers a range of features and tools that can help investors and financial professionals analyze and track the fixed income market. Some of the key features include: Real-time data: Bloomberg provides real-time data on government and corporate bonds, including prices, yields, and credit spreads. Yield curves: Users can access a range of yield curves, including the US Treasury yield curve, the German Bund yield curve, and the Japanese Government Bond (JGB) yield curve. Credit default swap (CDS) spreads: Bloomberg provides data on CDS spreads, which can be used to assess the credit risk of individual bonds or issuers. Bond screens: Users can create custom bond screens to filter bonds by criteria such as yield, credit rating, and maturity.